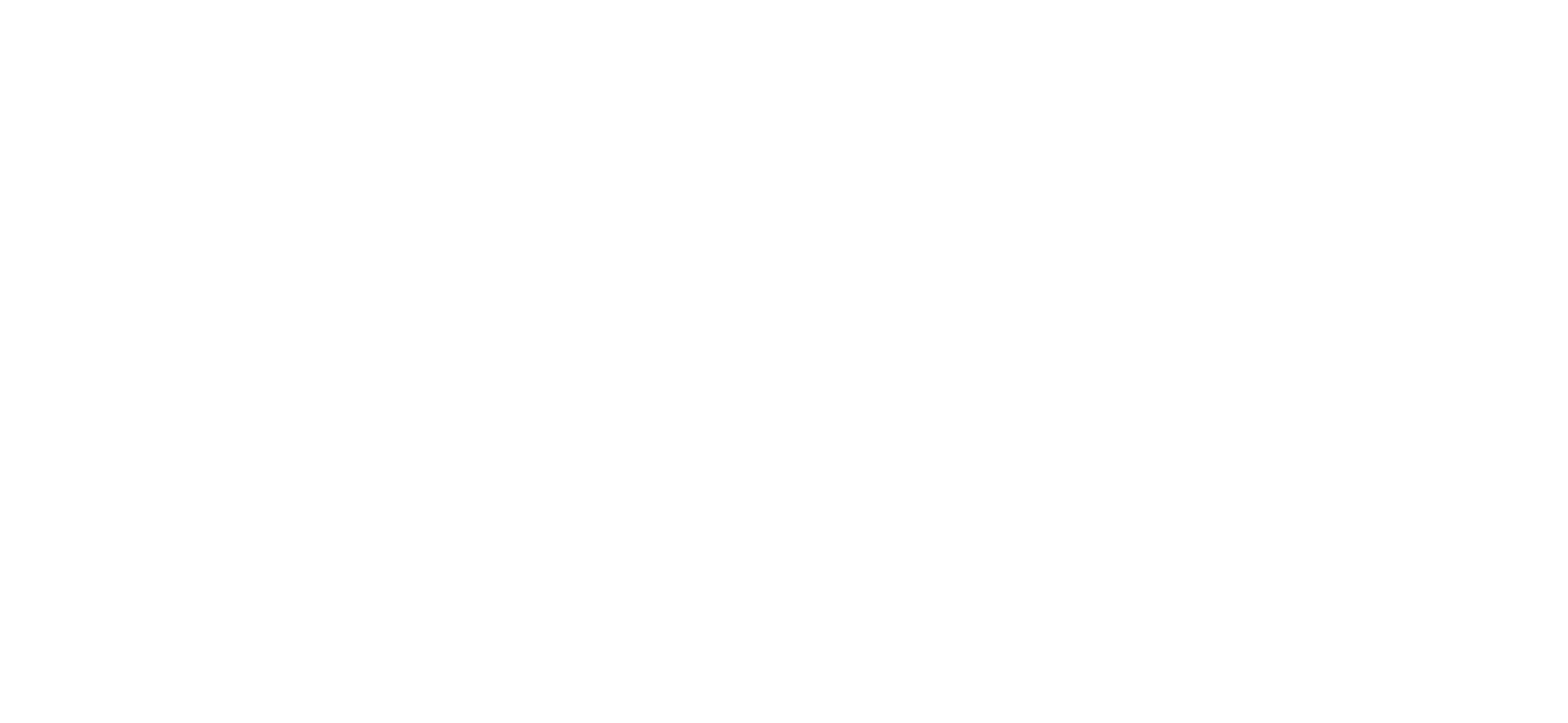

Thematic investing is emerging as an increasingly pivotal approach for many investors. Major themes such as Cybersecurity, Artificial Intelligence (AI), and Fintech have yielded significant returns, while former favorites like battery technology and renewables have fallen short of expectations. Somewhat surprising to outsiders, Uranium has risen to prominence, second only to Crypto, in capturing the top investment spot.

Starting one's analysis based on the themes one believes will perform well is a good beginning. Below, we see various thematic investments in the form of ETFs and their development over the past year.

It may not be surprising to see crypto, uranium, AI, and cybersecurity on top, but it is somewhat striking that the "sustainability play" continues to be ice cold. Solar energy, wind power, battery manufacturing—all are completely frozen over. If we adjust the measurement period to just this year, we see the same thing. Apparently, the willingness to take risks has not seeped through to these areas.

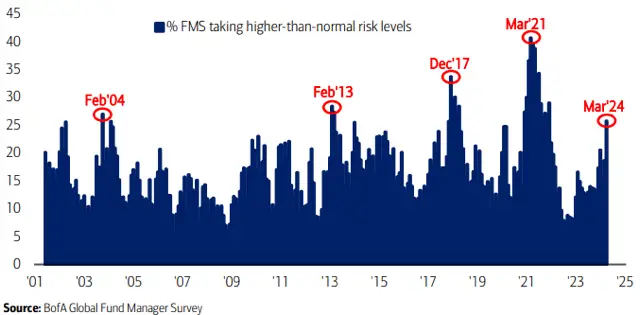

Where is the appetite for risk?

Inflation, high interest rates, delayed projects, and hesitant final customers are general explanations for the poor performance. Growth and profitability are still two parameters that the stock market wants to see, and these are generally not seen within these sectors right now. At least not to the extent that was previously hoped for.

Leave a Comment